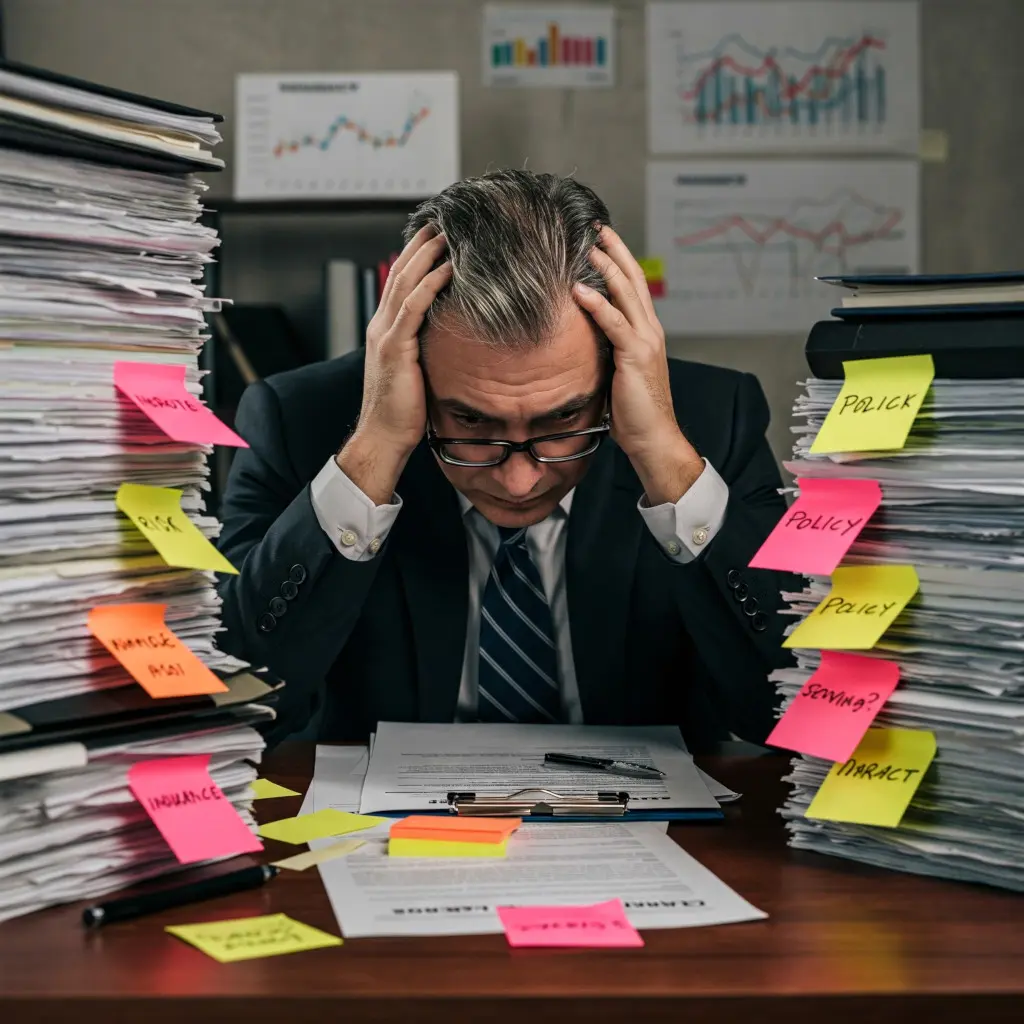

Insurance: YUK!

Why bother?

Why even step into that mess?

IT IS PAINFUL! The products keep changing.

Virtual Insurance Group Coaching

At LeverUpNow, we coach financial advisors to reintroduce insurance as a core part of their financial planning model. Backed by over 40 years of insurance expertise, our coaching isn’t just about education—it’s about achieving real, measurable results.

Develop the right mindset and identify gaps in your clients' coverage.

Together, we analyze client cases to find the best insurance solutions.

Learn how to communicate the value of insurance effectively.

Comprehensive! Diversify around Investments, Taxes and Time.

Collaboration among specialists leads to your best outcomes.

Tax diversification plays a crucial role in preserving wealth.

Helping clients save is the most impactful service an advisor can provide.

Unlock a 10x to 20x return on your investment.

If you stay for a year, your $4800 investment would be expected to return $50,000-$100,000 or more.

Not Ready to Enroll? Signup for our free Newsletter and Get Access to Our Resource Library!

For the last year I have worked with a team of 161 advisors (an outside RIA) to achieve tremendous success with insurance. Over 50 of them will do 100+ policies this year.

Level Up Your Insurance Game Today! Join our monthly blog & access FREE Resources!

Why bother?

Why even step into that mess?

IT IS PAINFUL! The products keep changing.

I AM biased on this one, as I truly believe the program is right for, and will work for anyone on your team.

It is right for veteran, “Senior” advisors

It is right for “junior” advisors, whether client-facing or not.

It is right for any staff person who already is, or who will become your “go to” person on the heavy lifting… 95% of the follow up work, including completing the application, coordination with the insurance company or DBS specialist, updating the client on the status of the application… the underwriting… and the policy delivery.

Remember, I believe the best model here, for all involved, will eventually be the development of your “Sherpa” for Risk Management. Ideally, the vision is that they will do everything on an insurance opportunity, allowing you to keep your focus on what you are already great at. We can’t be great at every “sleeve” of the financial planning process, so let’s have our internal team specialist, our Risk Management Specialist, begin to take on as much as possible (with the ongoing help of LeverUpNow and all the other resources we bring to your practice and to your clients). Then, keep taking on more and more.

A word to those developing “Sherpas:” With the cooperation of your team leader, this new direction has the potential to be a lifetime “specialty” career for you. If your team and/or assets are substantial enough, you may be able to create a unique career path right there! Or, there are AMP insurance specialists who work with multiple teams. That is possible for you as well. Just imagine what is possible over the next 5, 10, 20 years!

Importantly, while most advisors do not see Insurance as a constant, reliable, and lucrative cash flow generator… it now will be. That means just like AUM, it will come with a multiple. As AUM fee pressures become more and more challenging, insurance ongoing GDC will become more and more valuable!

And, most importantly of all: The Clients Need This!!

That is not planned, but if you anticipate having 4 or more people on your team enrolled in paid coaching, I am very open to a conversation about team discounts.

First, the MasterMind group calls are on the 2nd Monday of each month, at noon Pacific. And, the Case Analysis teams meetings are on the 3rd and 4th Fridays of each month, also at noon Pacific. (When a holiday intervenes, I’ll provide alternative dates). Also, the dates will always be posted on the website under the Events Calendar.

A detailed answer to provide information about your business, build trust with potential clients, and help convince the visitor that you are a good fit for them.

You can still learn! I will post a monthly blog. I will be adding short videos with ideas directed specifically toward AMP Franchise Advisors who want to improve their Risk Management skills. Look for other free resources posted to the website regularly.

All Group MasterClasses will be recorded and available for paid advisors on the website, including ones from any month before you joined.

What if I want additional help, additional coaching? I have a team of insurance specialists who would be glad to provide you with 1-1 coaching. We will leverage all the resources we possibly can, so I would expect most people will get all they need from our LeverUpNow program. But yes, we can connect you to 1-1 coaching.

No, it is simply a month-to-month commitment. However, I believe that staying for a year (or more) will be best for most of you. There is too much to learn to stay for much less than a year. I actually think many advisors will just continue with our program indefinitely.

This comes back to 3 key concepts:

No. I do not work for anyone other than you and your clients! We will be open, of course, to term insurance, but always to convertible term (I guess that is a bias!). We will look at various types of permanent coverage including second-to-die, and life policies that are designed more for Long Term Care, than for the death benefit. We will dive into Long Term Disability, other types of Long-Term Care, various types of business insurance, and anything the client may bring to us. WE will use both DBS and their very wide range of products and advisor services, and we’ll “LeverUp” the local, valuable resources of the Riversource external and internal wholesalers.

Will I miss important content that is required in order to learn a new strategy? No. Each Group Insurance MasterClass will have content that stands alone. Also, we will review concepts shared in previous sessions often, as research tells us we need to hear things repeated at least 5-7 times, before we retain it! Of course, in Case Analysis, we will often explore ideas covered in previous months and jump ahead to concepts not yet covered at all, but needed in the moment for the client cases.

No, in order to protect client confidentiality, we are not going to record these.

Oh… many! Personal growth pain is fine, but let’s reduce the professional pain at work!

We will reduce the following Pain Points